- Exceptional: 800 to 850

- Very good: 740 in order to 799

- Good: 670 so you can 739

- Fair: 580 to help you 669

- Poor: three hundred so you’re able to 579

Page Contents

step 3. Debt-to-Earnings Ratio

Lenders must ensure that home owners have sufficient earnings to safety all of their expenditures. Simply assessing your earnings might not bring an entire image, for this reason loan providers put better focus on the debt-to-money ratio (DTI) . The fresh new DTI proportion, expressed as a percentage, suggests so you can loan providers the new percentage of your gross month-to-month money one are allocated with the required expense.

Figuring your DTI proportion is pretty easy. Start with accumulated all fixed monthly premiums, excluding any variable expenditures.

- Front-stop proportion: Your proposed month-to-month homes fee as a percentage of one’s month-to-month earnings. The most side-stop DTI could be regarding 10 so you can several commission factors lower, otherwise 31% to thirty six%.

- Back-avoid proportion: Your existing monthly financial obligation repayments together with your advised month-to-month houses commission once the a portion of the monthly money. The most back-end DTI depends on the loan type of, credit history, or other facts particularly reported bucks supplies, and is usually 41% so you can fifty%.

cuatro. Possessions

Lenders would be interested in learning about the rewarding property your features. The point at the rear of loan places Neptune Beach this might be making sure that these property possess the possibility as transformed into monetary loans for many who find one financial hardships down the road.

These possessions normally cover a wide range of circumstances, particularly bucks membership, senior years membership, holds and you may securities, vehicles, boats, RVs, accessories, graphic, and you may antiques. To establish their possession and the worth of such assets, you might be questioned to add research, such as for example assessment letters. It is crucial getting loan providers having this particular article in order to precisely assess debt stability and see the amount of chance involved in the financing to you personally.

5. Documentation

Lacking suitable papers regarding real estate loan processes is also hold things up. Just like the indexed over, loan providers usually require:

- Tax returns about early in the day two years

- Two years’ property value W-2s or seasons-stop pay stubs. If you’re worry about-employed, other evidence of money

six. Possessions Form of & Goal

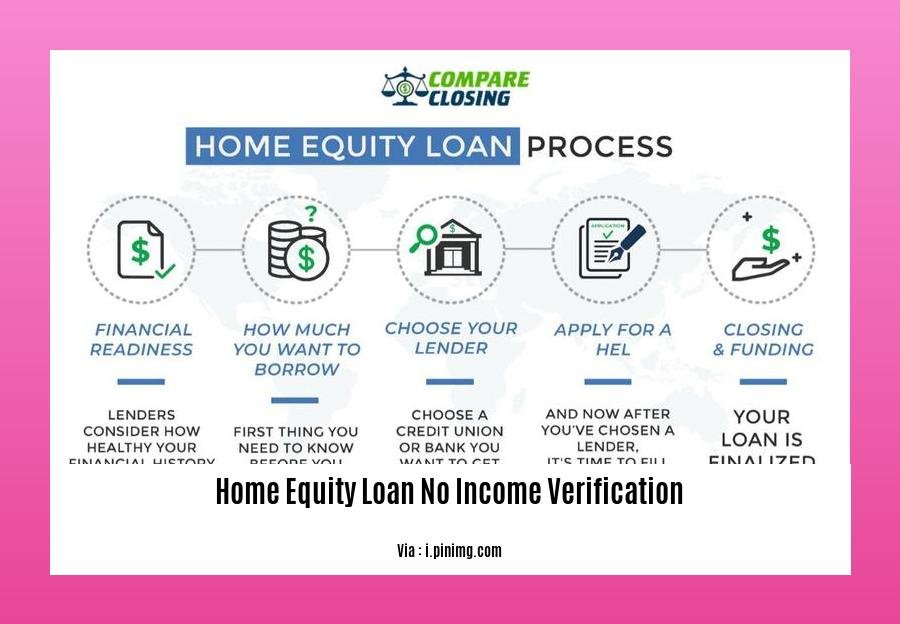

Yet, we discussed elements one see whether some one is meet the requirements to have home financing, according to its financial history. Although not, lenders including look at the function of the house you are interested.

Like, a great no. 1 house is actually a house which you propose to live in. You can usually get less interest rate and higher terms and conditions compared to if you were to buy a secondary home or funding possessions.

The sort of house you choose in addition to affects brand new criteria. Single-family unit members homes fundamentally include the best prices. On the other hand, there are some other variety of houses that will has a lot more charges. They have been apartments, co-ops, manufactured property, record belongings, mixed-have fun with advancements, and you may nontraditional tissues. Home which might be shaped like dinosaurs otherwise flying saucers can make loan providers a tiny uncomfortable.

eight. Downpayment

If for example the down payment was below 20%, you might have to buy financial insurance. This might be a compromise of a lot borrowers make being get a property sooner or later. The total amount you only pay to have home loan insurance rates expands since your down commission will get reduced and your credit score will get down.

Choosing to make a bigger advance payment you could end up a good quicker disaster loans. Although the loan doesn’t mandate dollars reserves after closing, you may want to own a hefty crisis financing. It will help shelter unanticipated household repairs and make certain you never exposure dropping your residence for those who feel work losses.