Page Contents

What is actually underwriting?

Your lending company uses underwriting to take measures to ensure your earnings, possessions, financial obligation, and assets facts along side path to granting your property financing. Its ways to slow down the financial lender’s chance inside delivering your on finance whenever you are ensuring you’ll be able to pay the family you would want to purchase.

Precisely what do you would like to possess underwriting?

Your home loan manager otherwise bank often request various files that respond to questions about your income and you can ability to manage your house.

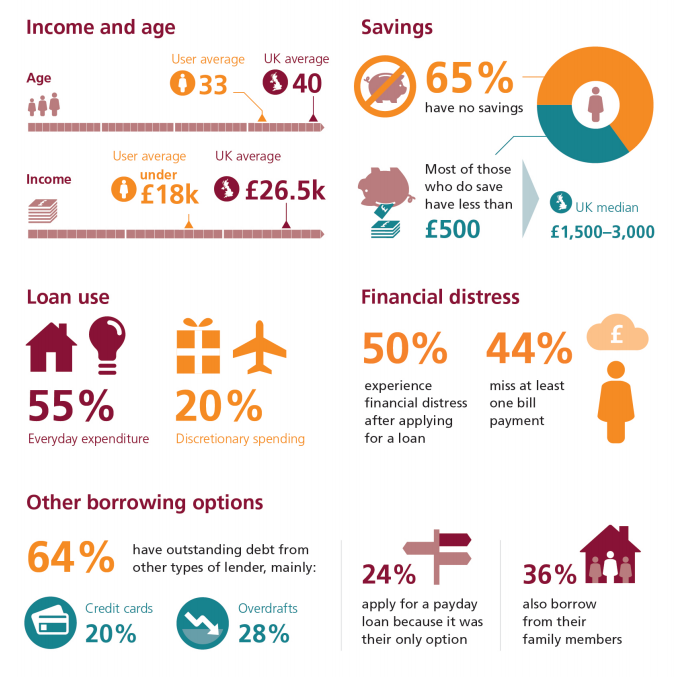

The lending company have a tendency to evaluate people obligations you have, eg funds owed on the auto, figuratively speaking, playing cards, or seats. The lender discusses people old-age coupons and you will expenditures. Taken to each other, these types of decorate an image of your financial fitness.

What goes on during the underwriting?

An enthusiastic underwriter try a monetary professional specifically taught to do this form of chance assessment work. Anyone investigates your finances to choose how much cash chance the lender takes whenever they select you be eligible for an excellent financing.

Fundamentally, it underwriter establishes if the loan http://paydayloansconnecticut.com/oxoboxo-river/ could be acknowledged or not. They want to make certain you don’t found a home loan you cannot afford and risks the lending company starting foreclosure process.

#1: Remark your credit history

The financing report shows your credit score and exactly how your put your credit previously. It choose warning flags for example bankruptcies, late money, and overuse of credit. A very clear list with a decent credit score implies that your are responsible throughout the paying costs. It advances your odds of loan approval in addition to top loan terms and conditions and you may rates of interest.

#2: Review your property assessment

The brand new underwriter feedback new assessment into the implied home. This new appraisal is always to check if the amount you are asking having in the capital aligns towards the house’s genuine worth. The latest appraiser brings comparable sales on area and you may inspects the fresh new home to ensure that the purchase price makes sense.

#3: Ensure your revenue

The underwriter has to prove your own a career condition and you may actual earnings. You typically you need around three variety of records to ensure your earnings, including:

- W-2s from the last couple of years

- Latest financial statements

- Their newest spend stubs.

Whenever you are mind-operating otherwise individual a giant express away from a business, your underwriter can look for various data files just like your funds and you can losses sheet sets, harmony sheet sets, and personal and you will team tax returns.

#4: Assess your debt-to-earnings proportion

The debt-to-money proportion is actually a fact that presents how much money your invest in place of how much money you earn. DTI try calculated with the addition of enhance monthly lowest loans repayments and you can splitting they by your month-to-month pretax earnings. The fresh new underwriter measures up the money you owe towards the money to ensure you have enough money to afford the monthly home loan repayments, fees, insurance policies.

And additionally month-to-month money confirmation, lenders want to see their possessions mainly because should be sold for money for people who standard on the mortgage payments.

#5: Be sure downpayment

Lenders should make sure you have enough funds to cover the brand new deposit and you can closing costs to your household buy. Underwriters as well as check your bank comments and discounts levels to help you ensure that you have enough money the sales and get arrangement traces you might create on closure.

Just how long really does financing underwriting simply take?

Depending on how hectic the underwriter try, this new approval processes usually takes 2-3 working days so you can work through various procedures. Most other people can hold within the recognition process, for instance the appraiser, term insurance, and any other additional items in the procedure.

Let rates along the underwriting procedure by actively responding to any desires on the people. Answer any questions rapidly and you can actually. Stop beginning the fresh lines of credit inside process, as that can complicate the recognition.

Once underwriting is gone.

Since underwriter is done, they accept, approve having conditions, suspend, or refuse the borrowed funds application. Brand new approval gives you the fresh all the-clear to close off toward house pick. For other determination, review why and discover when you can take the appropriate steps in order to replace your chances of another approval.