No cash aside greet

Individuals need to be accredited very first time homeowners that happen to be on the process of to shop for just one household members house for the town constraints of the Town of Sink. A first and initial time homebuyer is https://cashadvanceamerica.net/loans/payday-loans-for-the-unemployed/ a single or house who’s got perhaps not possessed a house because their primary house for the last 36 months (unless of course they are an effective displaced person).

Debtor need certainly to meet with the income qualifications restrictions put from the program to help you qualify for Area advice. Family money should not exceed the speed given from the Oregon Property and you will Community Features towards Oregon Thread system out of $64, having a-1 so you can 2 individual home or $74, to own step three or even more people on the household (such wide variety was susceptible to changes).Total family income mode the total earnings of all the citizens regarding the household. Within romantic regarding escrow, properties dont provides quick assets more than $seven,.

Borrower should provide enough papers of cash with the Area to have use in determining the new borrower’s earnings peak. Final devotion of a keen applicant’s money top and you will program qualification shall end up being the best discernment of your own Area or City’s agencies.

Debtor must fill out an entire app about four weeks past to their booked romantic of escrow. On determination regarding eligibility with the system, borrower should receive a letter saying just as much financing funds a buyer is approved getting. So it page determines qualifications just. Since capital is limited in fact it is available on a primary become very first suffice foundation, a page out of eligibility isnt a make certain money often be accessible into the borrower whenever requested.

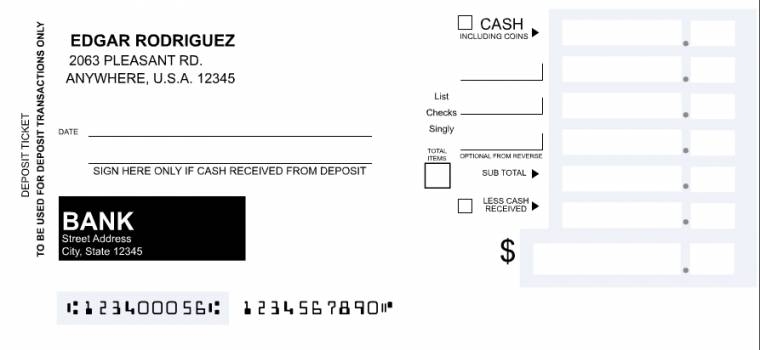

Borrower ought to provide funds during the an amount equal to the very least of 1% of your own cost for usage while the an advance payment. Such loans are a gift. These types of fund should be added to escrow prior to romantic and you may evidence of availability of money delivered to the city just before disbursal off Town fund.

Homebuyer need certainly to successfully complete a neighbor hood approved first-time homebuyer studies program and you may economic exercise training before the personal off escrow.

Top priority shall be given to individuals who live and/or work in the metropolis out of Drain. Selected authorities and you will City employees are eligible and really should feel preapproved by Urban area Council.

Home bought must be established single members of the family homes located in the town constraints of your Town of Drain. Land sold in almost every other metropolitan areas or in the fresh new unincorporated city inside otherwise close the town out of Sink do not qualify for new program.

Property bought should be unmarried-friends residences. Are created land should be on a permanent base and you may are manufactured belongings in the areas dont qualify for the application.

Customer need get a composed possessions inspection declaration away from a qualified domestic check team before the personal of escrow. That it statement need to shelter the significant possibilities in the home together with not limited by electrical, plumbing system, foundations, water drainage possibilities, color, and all depending-into the devices. House need to violation a pest and you can dry-rot assessment and meet safeness standards.

Debtor should get into a loan arrangement towards the Town of Drain since the overall number of funds lent of the Town. A good promissory note between your consumer therefore the Area discussing the brand new mortgage terminology are going to be executed and an action out of faith which have resale restrictions. Inability from the borrower so you’re able to comply with the fresh new terms of brand new promissory note and/otherwise faith action can lead to brand new standard of one’s City’s financing.

Mortgage should be subordinated only for rate and you may identity refinances (no money away) and at the sole discernment of the Urban area

Attention from the a fixed price of 5% should accrue to possess a period of a decade then time no extra attention was charged. Payment away from accrued interest is deferred and due in addition to the primary in the time of import off title or re-finance.

Loan money can be used only to buy property and you can to pay for people nonrecurring settlement costs associated with getting the domestic. Customer will perhaps not have fun with loan fund to invest in fixes, space enhancements or to purchase people low-real property.

Total mortgage amounts and you can settlement costs might not surpass brand new lesser off either 99% of appraised value of the house or 99% of purchase price. It have to be affirmed ahead of the intimate out-of escrow using this new distribution off an assessment report prepared by a licensed real estate appraiser. New appraisal need been completed 3 to 5 months early in the day with the personal off escrow.

First mortgages must be repaired rates funds without bad amortization, balloon money otherwise varying speed enjoys. City supplies the legal right to reject recognition out of that loan established toward negative regards to the original mortgage.

Rewarding these criteria is the only responsibility of your own homebuyer. Inability to completely satisfy the over system requirements because the determined by the city otherwise City’s agent can result in a delay in financial support or even in mortgage denial.