Page Contents

Conceptual

Financial rates can differ most round the borrowers and so are usually less than the high quality variable prices (SVRs) stated from the financial institutions. This article uses mortgage-peak analysis to explore the latest relationships between rates of interest while the qualities of borrowers and their funds. Mortgages that have riskier characteristics generally have higher rates. Discounts placed on SVRs provides had a tendency to improve more than the last few years, and loans Tucson Arizona so are dependent on the sort of loan as well as dimensions.

Addition

The typical financial around australia provides a changeable rate of interest and is actually priced with reference to a standard SVR. SVRs is an indication prices reported of the loan providers and are impractical to function as the genuine rate of interest reduced towards the that loan. Individuals are usually given savings within these SVRs, and that are very different according to the functions of one’s borrower as well as the loan. Deals may differ by facilities and also the level of deals possess ranged through the years. It is hard to get complete investigation to the quantity of interest levels in fact repaid because of the consumers since banking institutions use both advertised and you may unadvertised offers. Once the middle 2015, this new Reserve Financial could have been collecting mortgage-height investigation towards home-based financial-supported bonds. These types of studies try built-up in the Bank’s Securitisation Dataset and supply fast and you will detailed information towards the mortgage loans. We use these analysis to explore the newest relationship ranging from interest levels in addition to attributes off borrowers and their loans. In the event that banking companies explore chance-situated rates, then mortgages with safer attributes will tend to located large savings.

The fresh new Securitisation Dataset

The brand new Reserve Financial welcomes particular asset-supported securities as the collateral within its domestic business surgery. In order to be approved because the collateral, detailed information concerning the possessions underlying the fresh bonds in addition to their structural keeps are formulated accessible to the Reserve Lender. The Securitisation Dataset lets the fresh new Set aside Lender (or other traders) so you’re able to a great deal more accurately assess the chance and costs of these bonds, decreasing the dependence on score providers.

All the advantage-recognized bonds in the dataset try underpinned from the home-based mortgages. The brand new Securitisation Dataset currently receives analysis (which have a single-times lag) towards the step 1.eight mil individual residential mortgage loans with a total value of as much as $400 mil. It is the reason on one-quarter of one’s full value of construction finance around australia. Detail by detail analysis arrive on each loan. Up to 100 analysis industries try accumulated, plus loan functions, borrower characteristics and information on the house fundamental the loan. Including granular and you may fast data are not offered off their provide and the dataset are often used to see worthwhile insights on the financial markets.

Regardless of the dimensions and you will depth of your own dataset, the newest financing regarding the Securitisation Dataset is almost certainly not affiliate of the complete financial field across each one of their proportions. The kinds of mortgages which might be securitised is generally dependent on ways credit ratings firms designate ratings, the sort of lender, investor needs, and by this new Put aside Bank’s repo-qualification construction. Having said that, with the aggregate metrics such as investor and you can attention-merely offers and you can mediocre mortgage-to-valuation ratio (LVR), the sample out of securitised loans appears to be zero riskier than the fresh new larger people from mortgages.

Interest rates and Deals

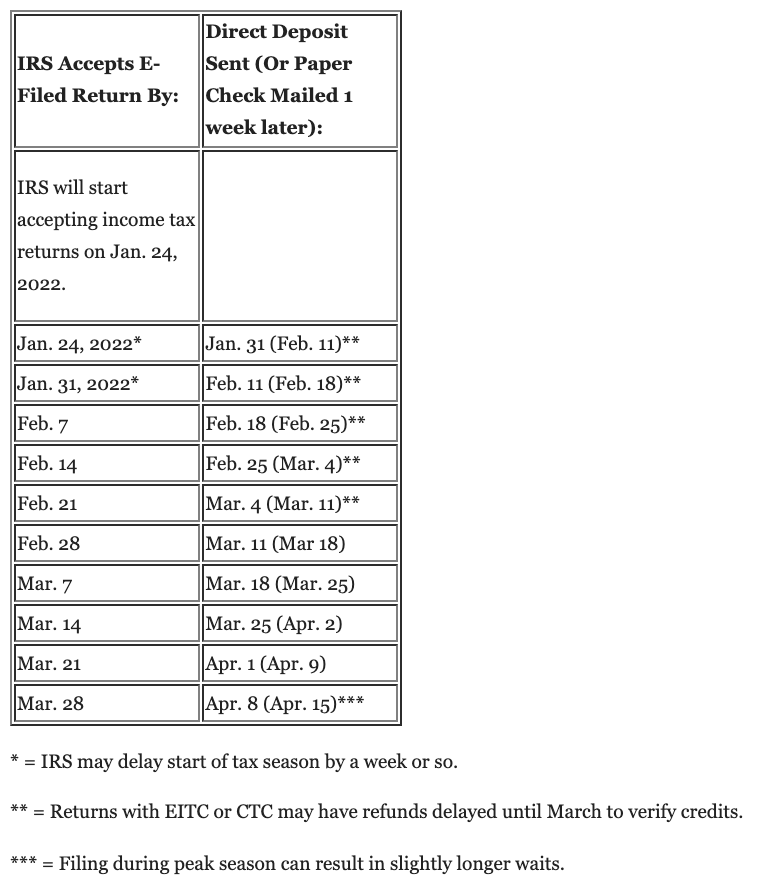

Regarding decades just before 2015, banks perform basically for each and every place you to definitely main SVR for mortgages which have zero distinction between the various brand of financing. Over the past few years, banks has actually brought differential rates as a result to steps by Australian Prudential Regulation Expert (APRA) to place limits to your investor and desire-simply financing and also to increase financing standards. Finance companies today advertise SVRs into four fundamental types of loans across the several dimensions: perhaps the debtor are a proprietor-occupier otherwise investor, and whether the financing payments was prominent-and-attention (P&I) otherwise attention-simply (IO) (Chart 1).