The silicon carbide market in 2023 exhibited diverse price trends across key global regions. In Asia, the first quarter saw price increases driven by sustained demand, particularly from the pharmaceutical sector, and external factors like cultural events and geopolitical tensions. However, the second quarter brought a sharp decline, primarily due to reduced purchasing activities and a contracting manufacturing sector.

Request for Real-Time Silicon Carbide Prices: https://www.procurementresource.com/resource-center/silicon-carbide-price-trends/pricerequest

In Europe, the first quarter witnessed initial price surges resulting from high input costs and inflation, but the second quarter witnessed a significant decline in silicon carbide prices, driven by reduced manufacturing activity, lower consumer sector demand, and rising inventories, creating pressure on trading activities.

North America experienced an upturn in silicon carbide prices in the first quarter due to rising raw material costs and strong domestic demand, but the second quarter saw a price decline influenced by downturns in both domestic and international supply and demand, along with global economic challenges impacting energy costs. These region-specific trends highlighted the intricate interplay of market dynamics and external factors shaping the silicon carbide price trajectory.

Page Contents

Definition

Silicon carbide (SiC) boasts a range of remarkable chemical properties that contribute to its versatile industrial applications. As a compound of silicon and carbon, SiC is exceptionally hard, with a structure similar to that of diamond. This property makes it a valuable abrasive material in various applications, including grinding, cutting, and polishing. SiC is highly refractory and can withstand extremely high temperatures, making it ideal for use in high-temperature environments, such as refractories in industrial furnaces. Its chemical inertness and resistance to corrosion render it suitable for aggressive chemical applications and as a component in high-temperature materials like crucibles and thermocouple protection tubes.

Key Details About the Silicon Carbide Price Trend:

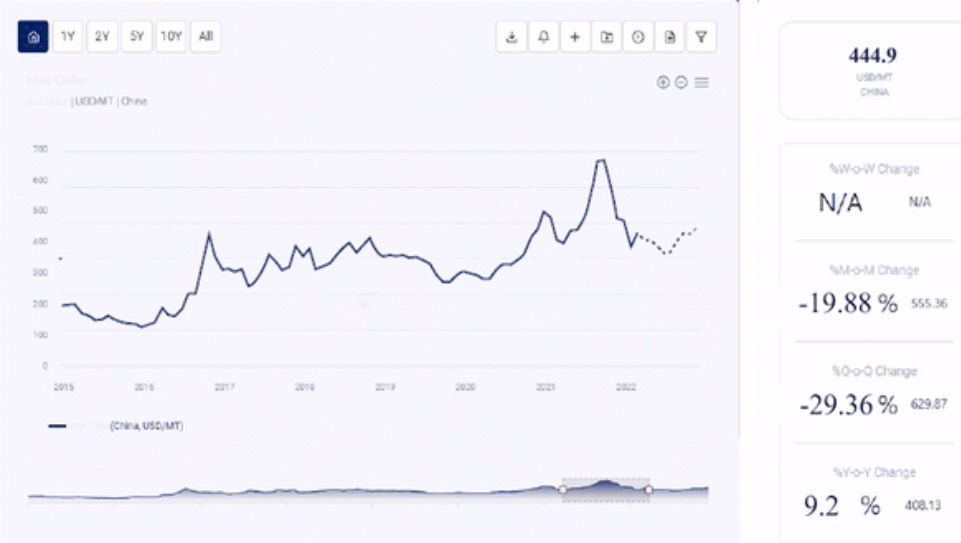

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on Silicon Carbide in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as Excel files that can be used offline.

The Silicon Carbide Price chart, including India Silicon Carbide price, USA Silicon Carbide price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting the Silicon Carbide Price Trend:

Silicon carbide (SiC) Price Index is a versatile material with a wide range of industrial uses. Due to its exceptional hardness and abrasive properties, SiC is commonly employed as an abrasive material in grinding wheels, sandpapers, and abrasive powders, making it vital in metalworking, woodworking, and precision grinding. Its high thermal conductivity and ability to withstand high temperatures have made it a key material in the electronics and semiconductor industries, where SiC is used in power electronic devices, aiding in efficient heat management. In the steel industry, silicon carbide serves as a reducing agent in the production of iron and steel, enhancing the quality of metals and alloys. Moreover, SiC’s chemical inertness and resistance to corrosion allow its use in aggressive chemical environments, including water and wastewater treatment.

Key Players:

- ALLEGRO MICROSYSTEMS INC

- Infineon Technologies AG

- ROHM Co Ltd

- STMicroelectronics N.V.

- ON SEMICONDUCTOR CORPORATION

- WOLFSPEED INC

- Mitsubishi Electric Corporation

- FUJI ELECTRIC CO LTD

News and recent development:

- Onsemi has announced that its cutting-edge, biggest silicon carbide facility in the world is now fully operational in South Korea. When operating at maximum efficiency, this fabrication facility can produce over a million 200 mm SiC wafers annually. (Dated: 25 October 2025)

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients with up-to-date and pioneering practices in the industry to understand procurement methods, supply chains, and industry trends so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Jolie Alexa

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA