Do i need to sell my house? How can i manage costs back at my home loan with less than perfect credit? Must i refinance despite less than perfect credit? Talking about all-important issues if you’re making reference to mortgage loans and poor credit.

Home ownership shall be a stunning capital. And in case you do your hunt it can be economically of use ultimately. However, of many Us citizens that are striving economically may feel caught up of the domestic possession.

The initial step is understanding just what a mortgage is actually. About greatest terms, a mortgage is just financing for buying a home. They tend as very big finance, due to the fact house are expensive. Also, they are always offered with fees terms long-term fifteen or thirty years.

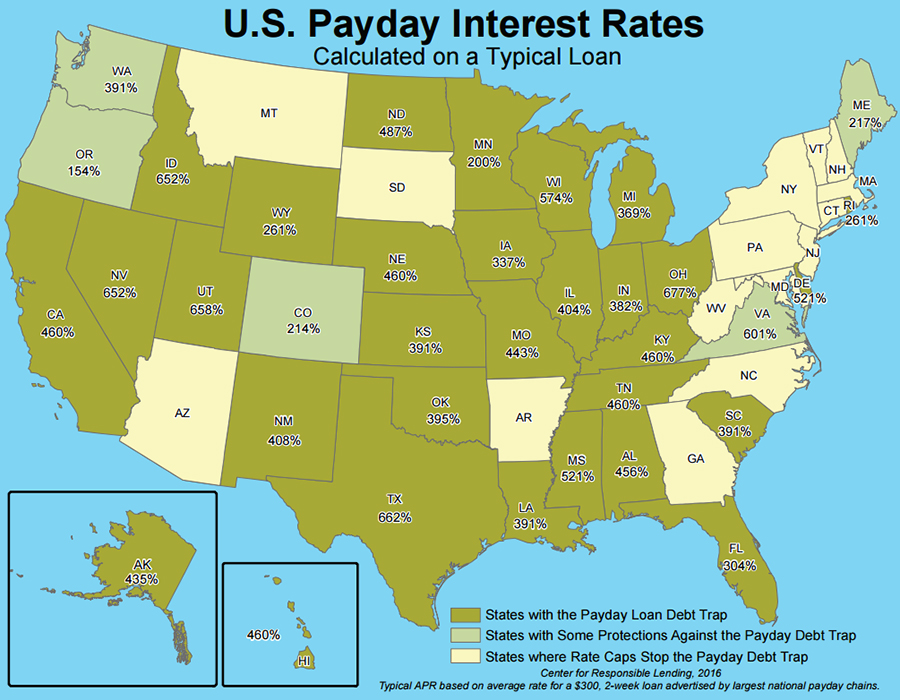

Whenever making an application for a home loan your credit rating might be analyzed to decide your own rate of interest. A better credit history function a lowered complete interest, or Annual percentage rate (annual percentage rate). Shortly after you happen to be recognized getting a home loan you can purchase the home and start paying the borrowed funds.

- Down payment per month

- Paying off the loan quicker

- Eradicate economic worry

- Changing the type of interest rate

- Opening the collateral yourself

So just how does home financing re-finance work? It’s very similar to the processes on first home loan. There are a lender that provides these financing, otherwise use the exact same business while the initial financial. You’ll sign up, the lending company usually select should it be acknowledged, of course very you are considering another type of mortgage.

Page Contents

Do you really Refinance Which have a credit score Around 600?

Same as that have any other type out-of loan, which have a good credit score form so much more beneficial mortgage options. Even though it are you’ll be able to to get a mortgage-or even re-finance-with bad credit, its most certainly not easy.

Oftentimes, needed a credit score out-of 620 or more having a conventional re-finance. That said, there are usually choice. Of a lot authorities apps occur to aid individuals that have shorter-than-beneficial borrowing. The brand new apps let consumers get mortgage loans and you may re-finance all of them even though the credit history is lower than just 600.

When you yourself have a credit history away from 600 or below, searching of these programs online. Try trying to find government financial guidance applications near you.

What exactly is a keen FHA Loan?

FHA means Government Construction Administration. This is an application that can help borrowers having bad credit score the support needed having mortgage loans and refinancing. The FHA means such financing, plus where can i get a personal loan with bad credit in Oakland they are considering using other FHA-approved lenders.

The fresh new FHA and additionally facilitate borrowers which actually have mortgage loans, with all of the refinancing needs. You will find some different choices to refinance towards FHA. A keen FHA improve refinance, for-instance, could possibly get allow the borrower locate less interest rate. An FHA dollars-aside re-finance, on top of that, gives the debtor the possibility to acquire another type of, huge mortgage and you may receive dollars for the improvement.

What’s a finances-Aside Refinance?

Which have a normal re-finance you’re getting a new mortgage with various terms. Perhaps you may be reducing along the loan, or providing a much better rate of interest. Having a finances-away re-finance the new financing was bigger than the amount your already owe. The financial institution following will give you bucks on the differences.

When you currently nevertheless owe $100,000 in your house, you may get $120,000 courtesy a funds-out refinance. The other $20,000 would go to your as the a personal bank loan from sort. Make use of it extra money so you can renovate or remodel, purchase unanticipated debts otherwise issues, otherwise any kind of cause you notice match.

Helpful advice for Refinancing your own Home loan which have Poor credit

The best way forward we are able to make you at CreditNinja, would be to do your homework and you may get it done carefully. Be sure to look into government guidelines software, or any other loan providers. And do not end up being hurried on finalizing the files if you’re not 100% yes it will be the best decision to you personally.