That it text message may possibly not be in final mode and may even become upgraded or revised subsequently. Reliability and you will availableness ming ‘s the tunes list.

You can assume one to home loan prices might be dropping nowadays adopting the Government Set-aside cut interest levels by 50 % of a time history day. However, recently, financial rates jumped highest, due to their greatest increase since sley, NPR’s private funds correspondent. Hey, Laurel.

WAMSLEY: That’s true. The fresh new data of Freddie Mac computer indicated that an average 30-year home loan price had risen up to six.3% recently. Which is from the a-quarter section more than it was 14 days back. That’s most likely an unwanted amaze toward people who find themselves eventually stopping the brand new sidelines first off looking a house. Why is it going on? It is because mortgage prices aren’t tied to the fresh Fed’s rate of interest, but rather, it pursue a special amount. It give into a good 10-seasons treasury bond, and therefore went large recently for a number of causes.

WAMSLEY: Zero, it is determined by brand new Provided, but it’s perhaps not lay by the Provided. And just have keep in mind that your neighborhood lenders whom in fact leave you their financial have to safeguards its will cost you while making a profit, so that they include her commission at the top.

WAMSLEY: Yes, and that is the big picture when deciding to take of which nevertheless. Despite so it uptick, financial costs be much more than just the full part less than it was basically now a year ago, and lots of men and women are capitalizing on that. They truly are refinancing their mortgages whenever they bought a house throughout the last few age whenever rates was basically higher. The low rates imply they could possibly rescue hundreds of dollars thirty day period.

RASCOE: Which sounds like home loan pricing try kind of a moving address now. Will there be one sense of where they will accept? And that is the thing i really need to know. In which will they be supposed?

WAMSLEY: Me and you both. So i posed one matter so you’re able to Lawrence Yun, the main economist in the Federal Association from Real estate agents, and you will here’s what he told you.

LAWRENCE YUN: I think brand new normal is generally six% home loan price, and that we have been most alongside. If we are lucky, maybe we become in order to 5 1/dos per cent mortgage rates.

WAMSLEY: Or we are able to be unlucky, the guy said, and the speed dates back up on 7%. And this sorts of forecasting is difficult, for even economists. But looking from the multiple predicts, a lot of them provides cost being significantly more than 6% through the avoid from the 12 months and you can shedding so you’re able to throughout the 5.8 the coming year. If you manage need it property, you do not have to wait to see if costs usually miss ’cause if they perform, you can constantly refinance in order to a lower speed. But if they increase, it really will get much harder to cover property.

RASCOE: Very home loan costs ran right up recently, even when rates was all the way down

WAMSLEY: Better, it’s still a small early to share with, while the to invest in a property usually takes weeks away from searching to really closing. But you will find some indications that straight down pricing are shaking things some time loose.

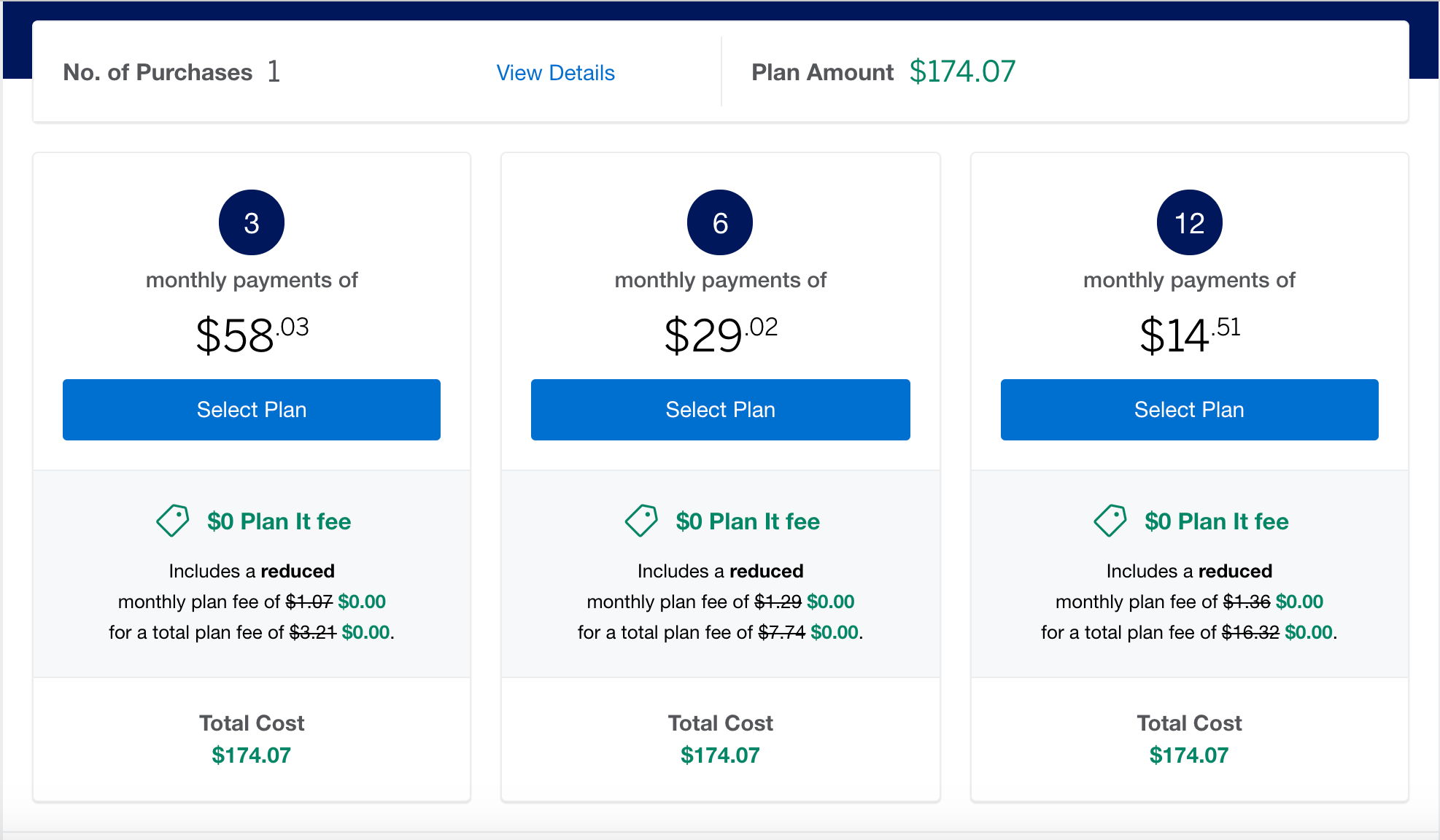

In addition to specific mortgage rates that you will score would depend on your own facts, like your credit history and also the proportions and type off financing you are bringing

WAMSLEY: Well, by way of example, more folks try checklist their homes for sale. Discover 23% way more present property in the industry than just there had been per year back. As there are a lot of the latest homes for sale, as well. That’s really good reports to own consumers that have maybe not got far available. And family vendors become homeowners as well, therefore those individuals everyone might possibly be going into the field in the future. And some suppliers have probably already been awaiting mortgage prices to help you miss because it is difficult to surrender the fresh new super-reasonable cost many locked in the within the pandemic, although they’re outgrowing the latest household. Right after which a separate sign would be the fact software getting mortgages enjoys ticked up a bit, 8% greater than last year, that also shows that more folks are intending to purchase good family.