Rating a loan pre-acceptance from a lender understand your restriction loan amount and reveal suppliers you happen to be a life threatening visitors. Within the pre-acceptance processes, a loan provider evaluates your financial situation and you may creditworthiness to decide your limit amount borrowed and offer a beneficial conditional connection having funding.

Page Contents

3: Ready your loan files

Collect necessary data files, such proof of earnings, family savings, bank comments, identification, taxation statements, and you can credit profile on your own nation from source, to support the loan software.

Seek compatible financing properties affordable making an enthusiastic bring toward the one that best suits your own conditions. Us states of numerous overseas buyers imagine include Arizona, Tx, Fl, Illinois, and you may New york.

Action 5: Mode a You organization particularly a keen LLC

Establish an excellent All of us-depending organization, including a small accountability organization (LLC), to hang new money spent and offer liability safety. To make a keen LLC, you must document Blogs out of Team on the suitable condition department and you will afford the required processing charge.

Step 6: Finish the loan application

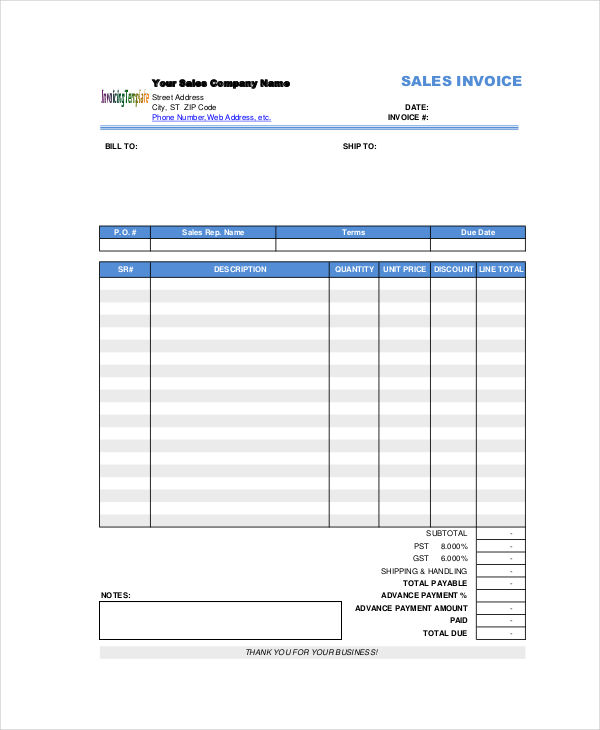

![]()

Fill in their complete loan application and you can support data to your financial for opinion, making certain every necessary information is particular and up-to-big date so you can support a soft and productive financing recognition process.

Step 7: Lock the pace

Locking the interest rate means protecting a specific rate of interest towards a loan to possess a-flat several months, generally speaking 31 so you can 60 days. Which covers the latest debtor from prospective action in the industry cost throughout the mortgage recognition procedure, guaranteeing they have the conformed-up on rate during the closing, aside from field conditions.

Step 8: Financing control and you can underwriting

The lending company will ensure all the conditions are met and you can be certain that their financial information. Underwriting advice are usually centered on five chief factors: Worth of, debt-service-visibility ratio (DSCR), borrower’s exchangeability, and you may borrowing profile yourself nation.

Action 9: Conduct a property inspection and you can assessment

A specialist inspector examines the fresh property’s standing during a home review, pinpointing possible circumstances otherwise necessary repairs. In an appraisal, a licensed appraiser assesses the house to incorporate an independent guess of its market price, helping the lender concur that the loan number is acceptable to own the fresh property’s worth.

Action 10: Plan closure or take palms

Enhance to your lender, label organization, and you may merchant to make sure all of the requisite data files are located in buy and you can money are available for transfer. Review and signal the finally documents at the closing fulfilling, pay the expected settlement costs, and you can have the secrets to your brand-new investment property, marking the completion of the mortgage techniques and also the start of forget the excursion.

As to why Smart Investors Play with Investment for rental Property

Wise traders usually trust funding to acquire leasing characteristics rather regarding expending bucks for the entire purchase price. There are a few good reason why investment are an appealing option for people, plus it tend to results in increased return on investment (ROI):

- Investment accommodations property could possibly offer people a tax-effective technique payday loan Castle Pines for increasing their cash disperse. By subtracting mortgage notice costs off their pre-income tax money, traders normally decrease its income tax liability, that may release currency and this can be reinvested inside their assets otherwise useful almost every other opportunities. So it improved earnings may help investors broaden their portfolio, boost their rental possessions, otherwise purchase a lot more local rental characteristics to generate increased come back on the financial support.

- Using resource can help mitigate exposure. That with home financing program to borrow cash in place of spending bucks, traders decrease its exposure coverage by continuing to keep additional money to your submit case of emergencies.

- Opting for a sensible financing option for financial support can help dealers magnify output. Leverage other people’s money rather than only depending on their particular fund makes it possible for investors to find even more features and potentially feel better appreciate and cash circulate yields. This can lead to more significant long-label wide range manufacturing and a far more varied portfolio.